In April, the federal government proposed tax changes to capital gains that the Canadian Medical Association believes will be detrimental to doctors and exacerbate the ongoing access to care crisis affecting millions of Canadians.

As CMA President Dr. Kathleen Ross told the CBC, the changes come at a time when Canada is desperately trying to recruit and retain health providers: “I’m deeply concerned about how we staff our physician workforce of the future.”

It’s one of more than 20 interviews CMA spokespeople have conducted to call attention to the negative impact of increased capital gains inclusion rates on community-based medicine.

The CMA has been advocating for change on Parliament Hill in meetings with federal Health Minister Mark Holland as well as policy experts in the Prime Minister’s Office and Finance Department.

Most recently, the CMA sent a letter jointly with nine provincial and territorial medical associations urging Deputy Prime Minister Chrystia Freeland to reconsider proposed tax changes.

Here’s more information on why and how the CMA is standing up for physicians on this issue:

How the capital gains inclusion rate is changing

The federal government has proposed raising the capital gains inclusion rate from 50% to 66.67%. For individuals, this rate will apply to capital gains realized in the year, in excess of $250,000. For corporations -- including medical professional corporations -- the increase will apply to every dollar of capital gains. These changes are set to take effect as of June 2024.

How incorporated physicians will be affected by tax increases

More than 50% of Canada’s physicians are incorporated. Over the last decade, they have been encouraged to do so to help them operate community-based practices more efficiently, invest in ongoing improvements for patients and, since many doctors don’t have employer-funded benefits, save for sick days, time off, parental leaves and retirement. In practical terms, changes to the capital gains inclusion rate will cause a retroactive increase in tax on the retirement savings of mid- to late-career doctors and a disincentive for new graduates considering community-based practice.

How capital gains taxes will negatively impact access to care

The average doctor carries $300,000 in debt from years of post-secondary education. Those who set up practices can spend as much as 40% of their gross clinical revenue on office space, equipment and staff. Changes to the capital gains inclusion rate will add undue pressure on physicians with community-based practices and affect their ability to save for retirement, creating further barriers to retaining and recruiting physicians in Canada at a time when they’re desperately needed.

The CMA’s recommendations on capital gains changes

More than 6.5 million Canadians have no regular family doctor. Countless others are suffering from long waits for medical tests and procedures. The proposed increase to the capital gains inclusion rate puts improvements in health care following historic federal funding at risk.

The CMA, with the support of most provincial and territorial medical associations, has recommended:

- A full repeal or exemption for medical professional corporations from to the increase to the capital gains inclusion rate

- Or, at minimum, the introduction of tax measures allowing individuals to share the $250,000 capital gains threshold at which the higher inclusion rate would apply with the medical professional corporations they control, and indexing this threshold to annual inflation.

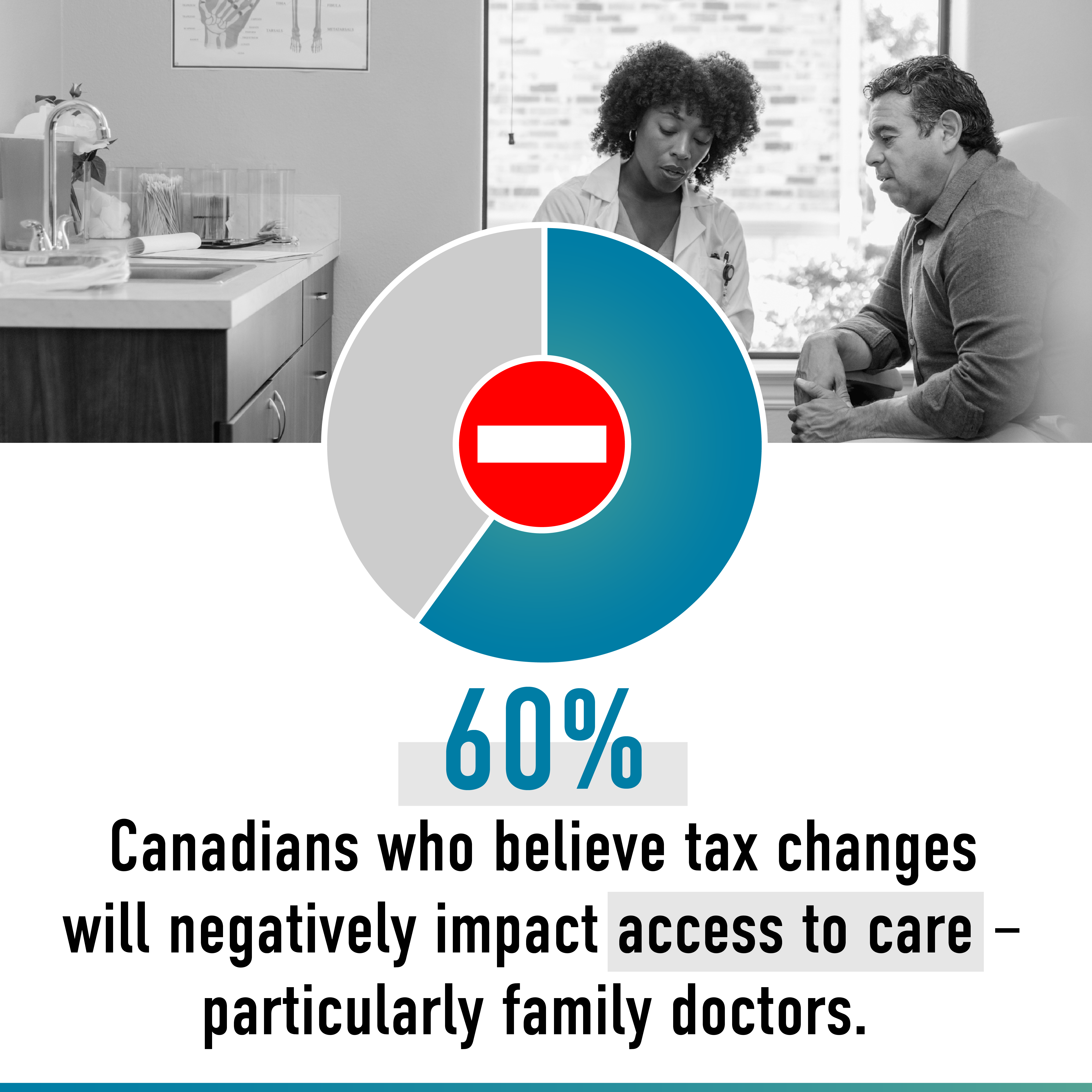

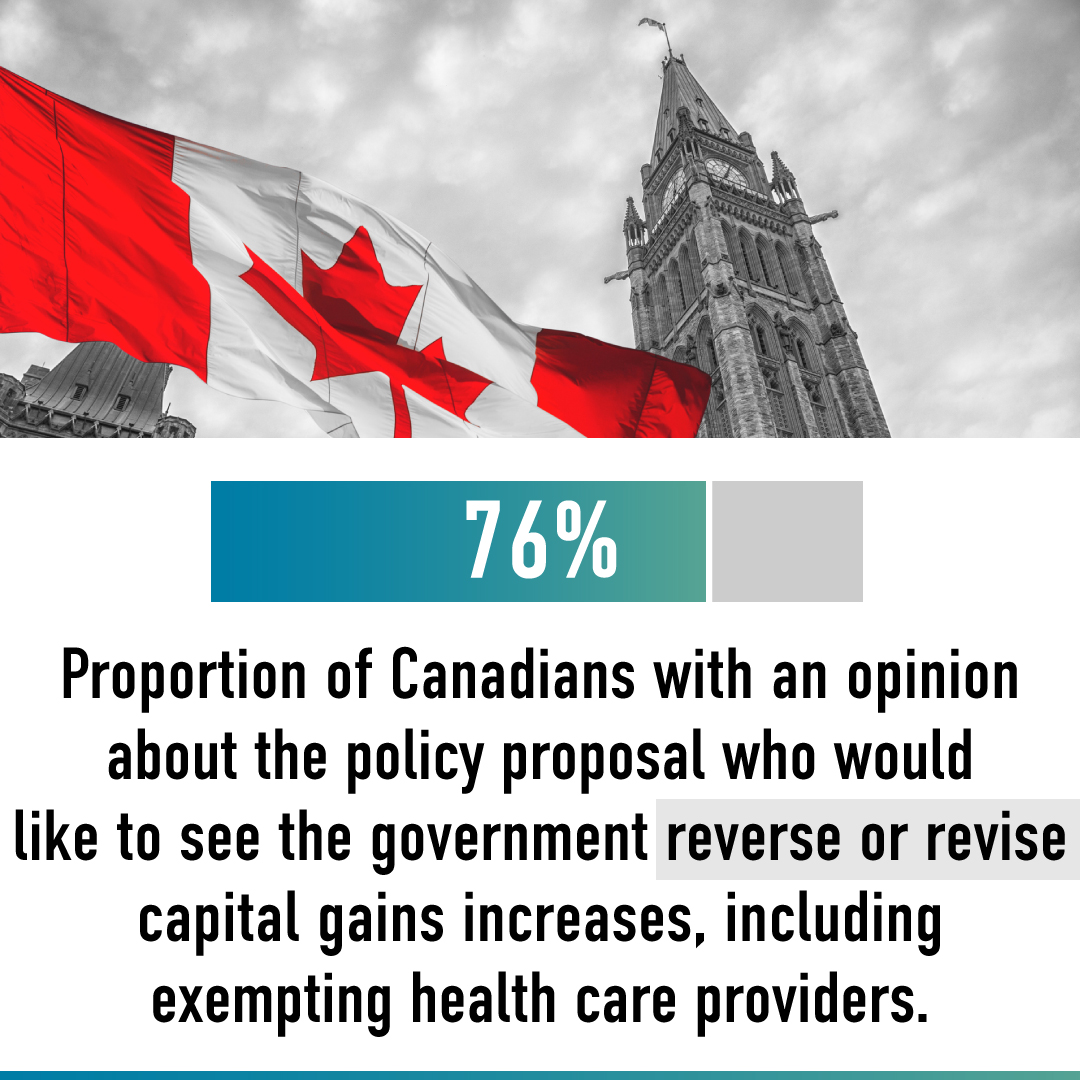

How the public sees tax increases for physicians

To understand how patients and the general public view capital gains increases, the CMA commissioned a national survey with Abacus Data. The results show clear concern about the impact of increases and support for physicians.

The CMA will continue to advocate for changes to proposed tax increases on incorporated physicians. Along with provincial and territorial medical associations, we are open to collaborating with the federal government on a definition of “medical professional corporations” to help distinguish physicians working for the public good from other business operations.

The bottom line: “We’re unique,” said Dr. Ross on CTV’s Power Play, “We need to be treated that way.”